Murray Math Lines 15.07.2011 (GBP/ CHF, USD/CHF, GOLD)

15.07.2011

Analysis for July 15th, 2011

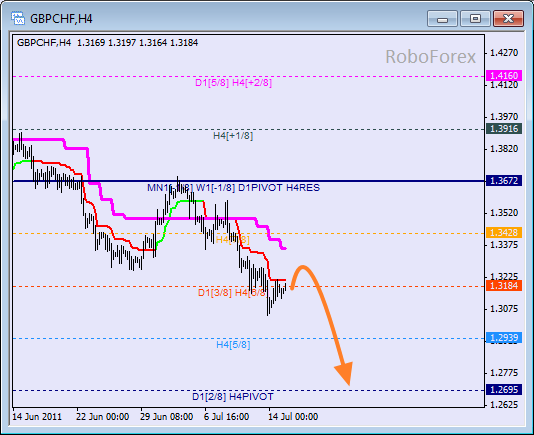

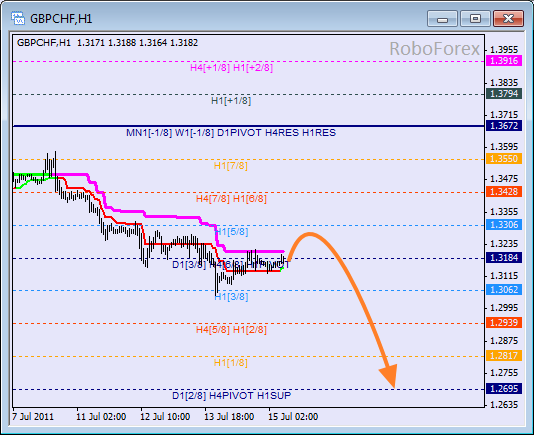

GBP/CHF

Down-trend is still being formed here. The price is being corrected at the 6/8 level, and is supported by H4 Super Trend. The market may test the indicator line, and if the price rebounds from this line, we will see bearish rally again. The target is the 4/8 level.

We can see the correction between the 5/8 – 3/8 levels. Bulls are slowed down by Super Trend lines. The market may test the 5/8 level. If the price rebounds from this level and goes back below Super Trends, it will be a signal for downward movement.

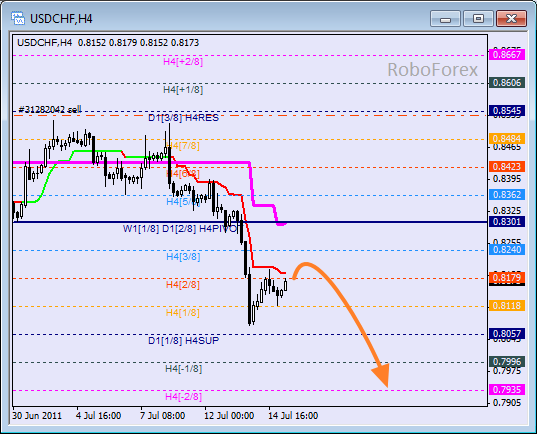

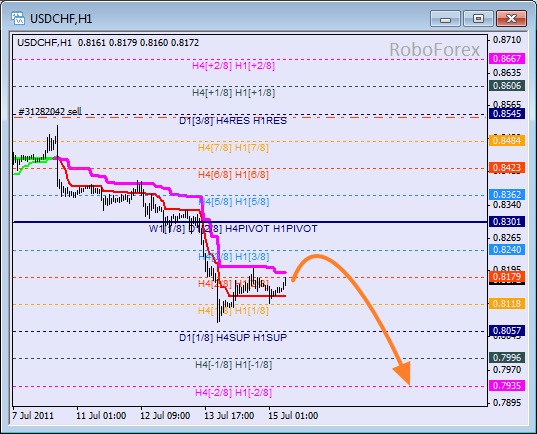

USD/CHF

The price is being corrected below H4 Super Trend. The market may test the indicator line once more, and the price rebounds from it, the market will resume its descending movement. The target is still the 8/8 level at the daily chart (0.7813).

It looks like the market will test the 3/8 level before moving downwards. If the price rebounds from this level, it will be able to fall to the -2/8 level. And if the price breaks the -2/8 level, the lines will be redrawn.

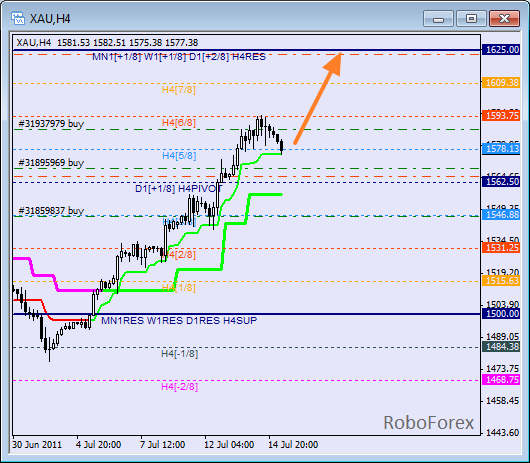

GOLD

The correction started at the 6/8 level. Since this level is quite weak and reverses hardly ever occur here, the price may start moving upwards to the 8/8 level. The correction is supported by H4 Super Trend, but the stop is below the daily one, just to be sure.

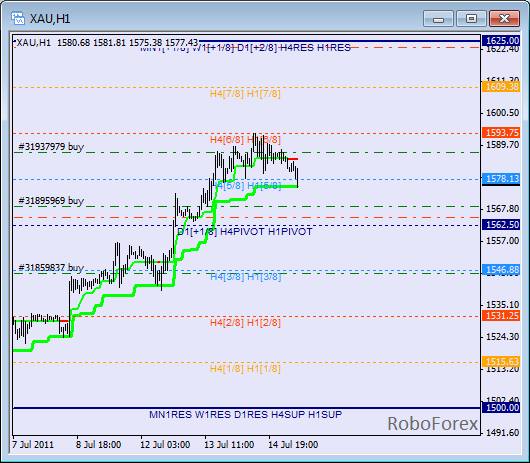

The lines at the H1 chart are the same as H4. The market is trying to rebound from Super Trend. If it succeeds, the price will be able to grow to the 8/8 level. Right now I have three orders and I’m not going to open more, ‘cause no matter how strong the trend is, one should follow money management rules.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.