Murrey Math Lines 17.06.2022 (Brent, S&P 500)

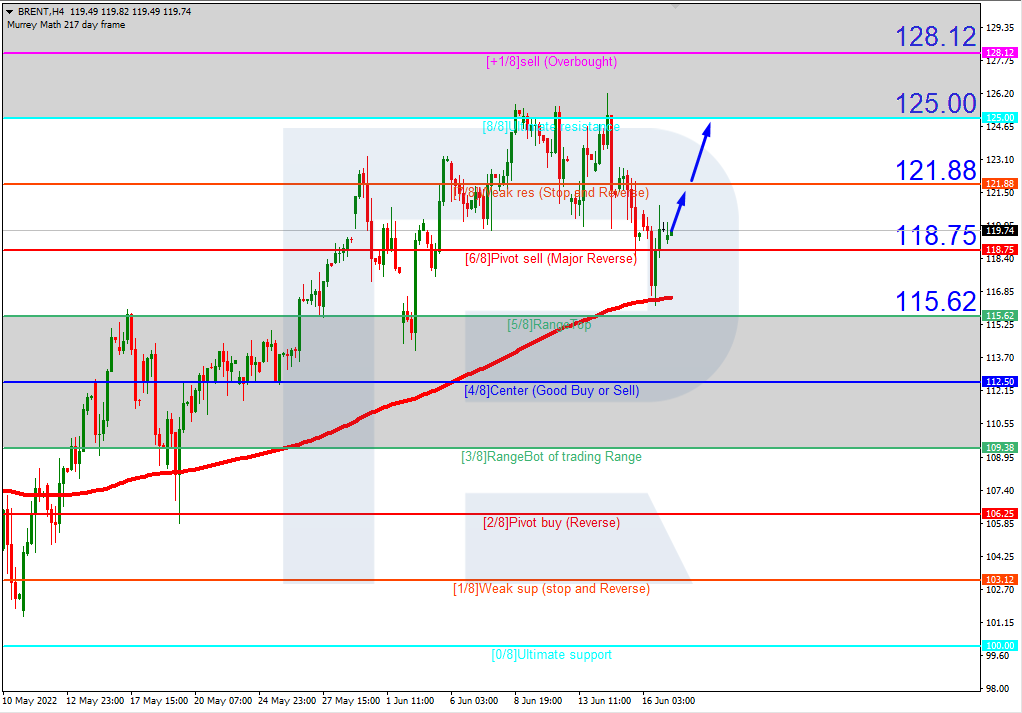

BRENT

On H4, Brent quotes have bounced off the 200-days Moving Average and are trading above it, indicating the end of the correction and the continuation of the uptrend. A test of 7/8 is to be expected, followed by a breakaway and growth to the resistance level of 8/8. The scenario can be cancelled by a breakaway of the support level at 6/8 downwards. In this case, the quotes can return to 5/8.

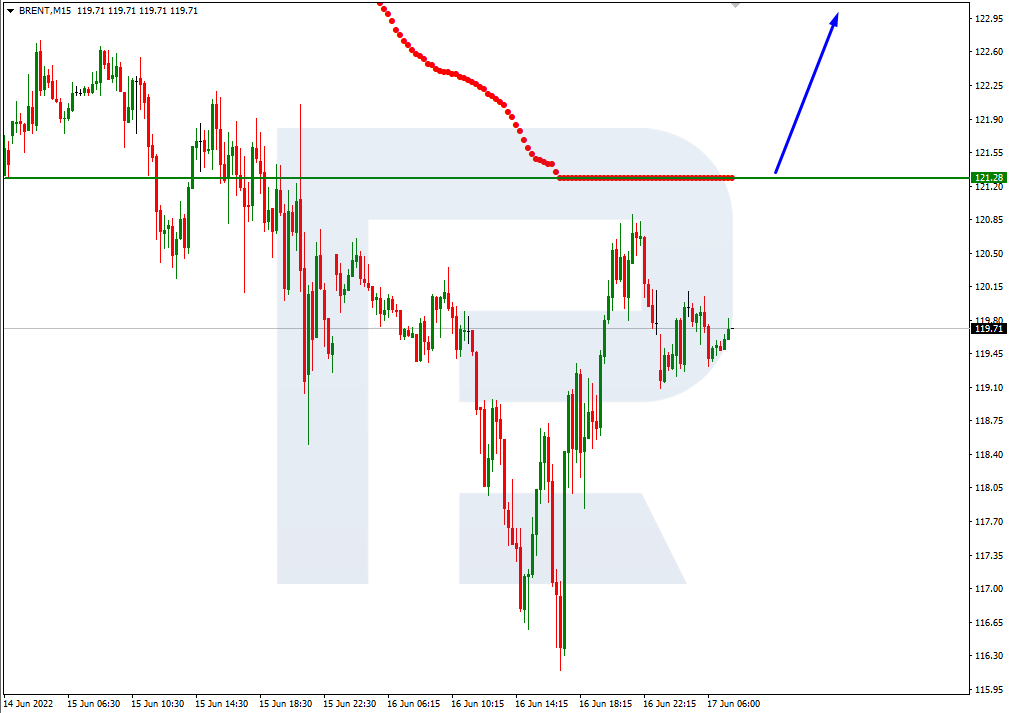

On M15, growth can be additionally confirmed by a breakaway upwards of the upper line of VoltyChannel.

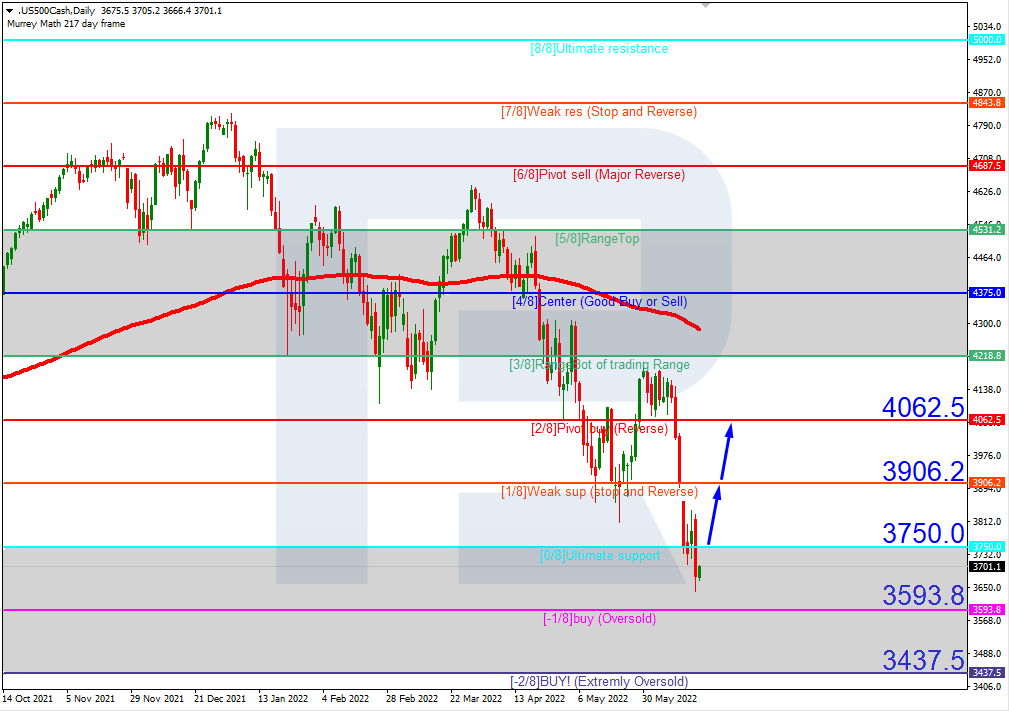

S&P 500

On H4, the quotes rest in the overbought area. A test of 0/8 is expected, followed by a breakaway and growth to the resistance level of 2/8. The scenario can be cancelled by a breakaway of the support at -1/8 downwards. This might entail further falling to -2/8.

On M15, a breakaway of the upper line of VoltyChannel will increase the probability of price growth.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.