Murrey Math Lines 22.03.2024 (Brent, S&P 500)

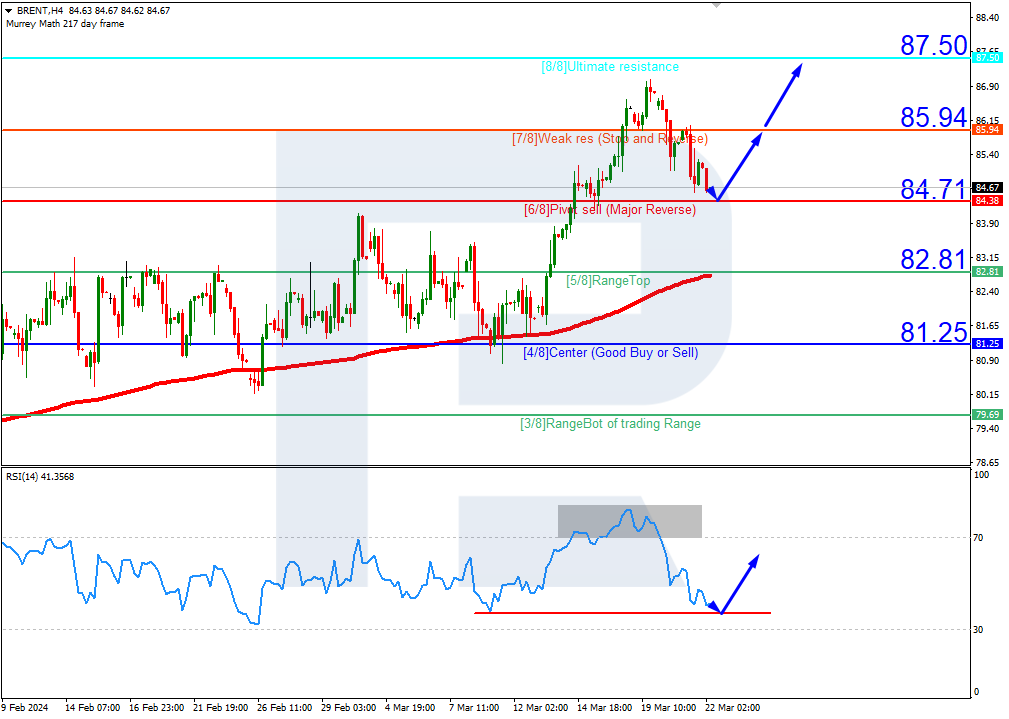

Brent

Brent quotes are above the 200-day Moving Average on H4, indicating a prevailing uptrend. The RSI is approaching the support line. In this situation, the price is expected to test the 6/8 (84.71) level and rebound from it, rising to the resistance at 8/8 (87.50). The scenario could be cancelled by breaking below the 6/8 (84.71) level. In this case, Brent quotes could drop to the support at 5/8 (82.81).

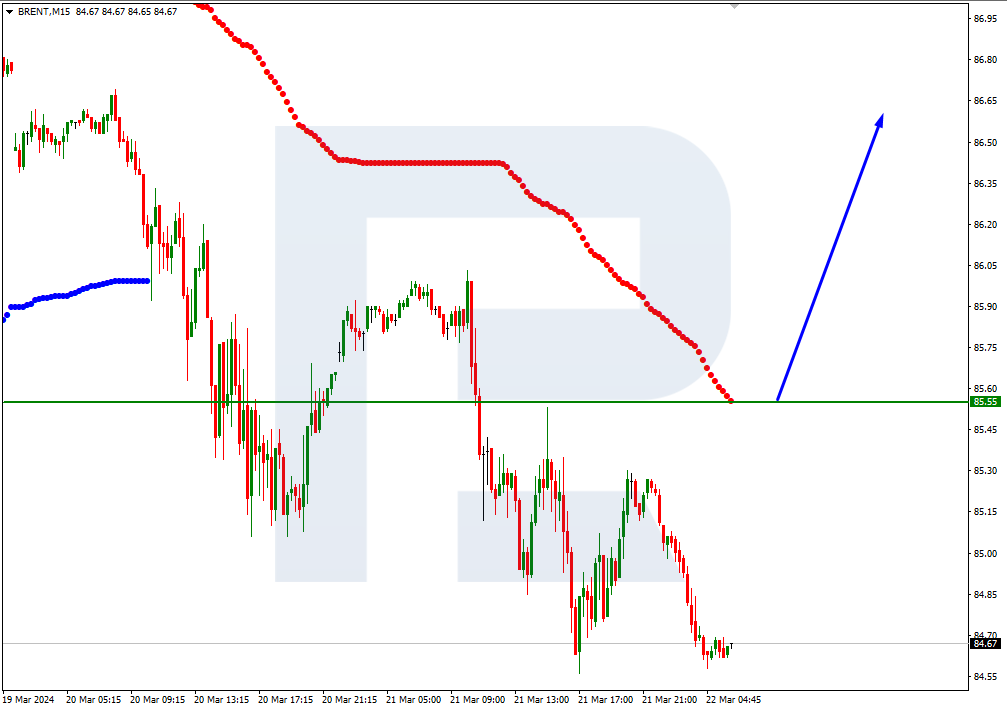

On M15, the price rise could be additionally confirmed by a breakout of the upper boundary of the VoltyChannel.

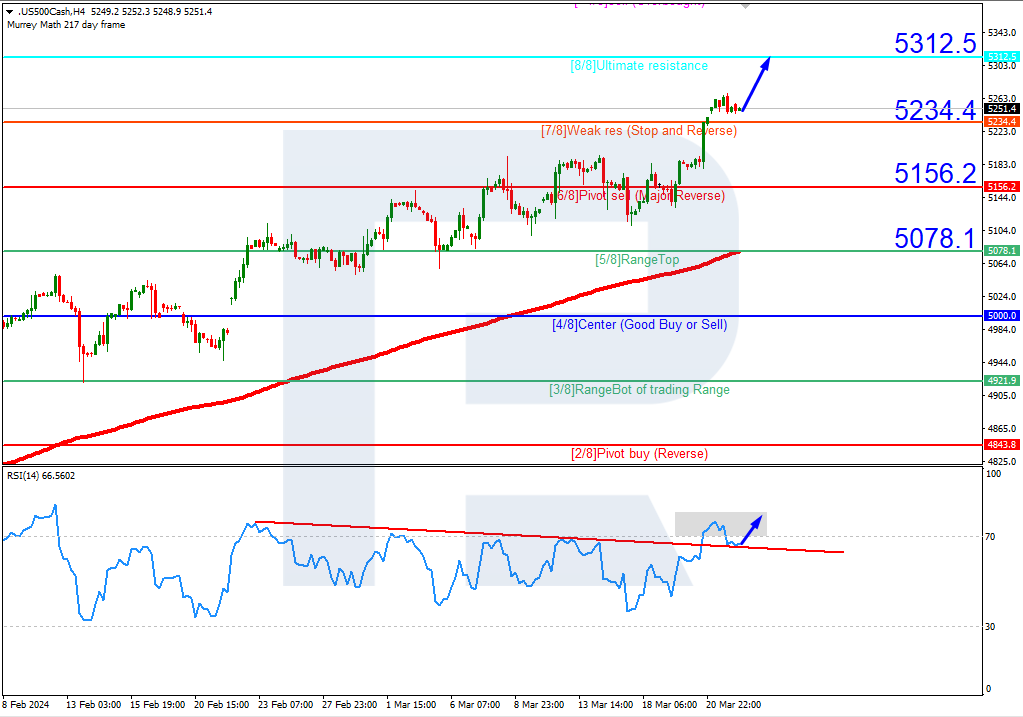

S&P 500

S&P 500 quotes are above the 200-day Moving Average on H4, indicating a prevailing uptrend. The RSI is testing the support level. In this situation, the price is expected to rise further to the nearest resistance at 8/8 (5312.5). The scenario could be cancelled by a breakout of the 7/8 (5234.4) level. In this case, the S&P 500 index could decline to the support at 6/8 (5156.2).

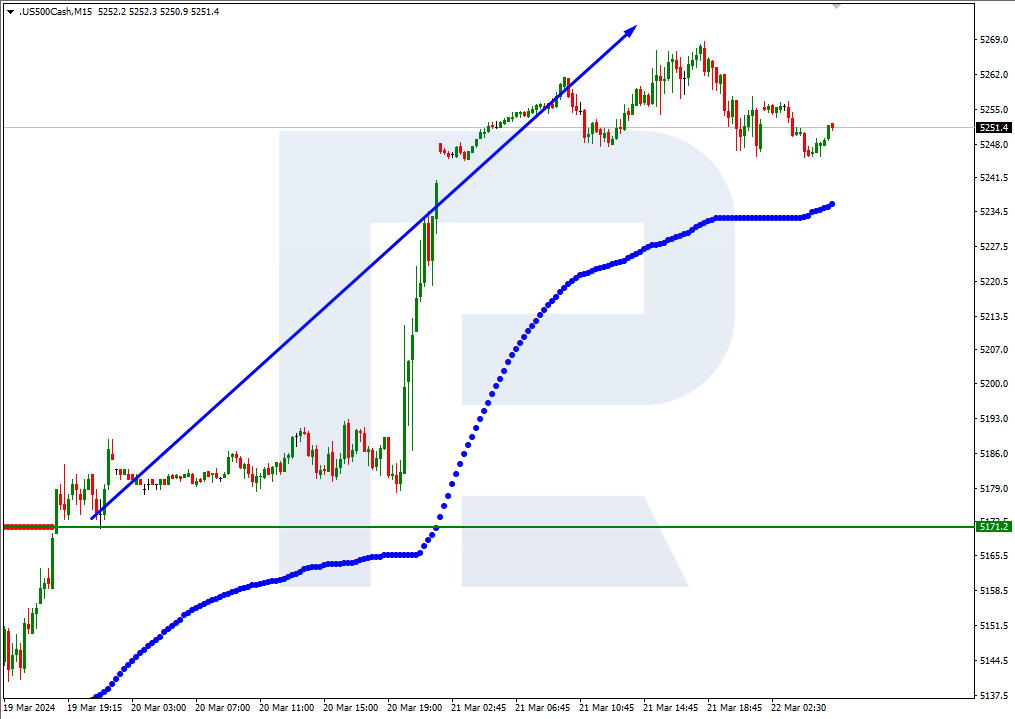

On M15, the upper boundary of the VoltyChannel is broken, which increases the probability of a further price rise.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.